Bookkeeping and Accounting Services for Truckers

Bookkeeping and Accounting Services for Truckers

At PorteBrown Accountants and Advisors, they understand that transportation companies are the lifeblood of commerce and the economy. So their accountants and bookkeepers work tirelessly to offer high-quality services to trucking companies nationwide. PorteBrown also draws on 75 years of industry experience and state-of-the-art accounting technology to ensure their accounting services’ accuracy. As the logistics industry Legal E-Billing in India continues to evolve, truck drivers in the country are also seeking efficient accounting solutions to support their businesses.

What happens when the Trucker CFO starts working for you?

This has opened up new revenue opportunities throughout the transportation sector. With many consumers buying goods online and more businesses expanding the scope of their operations via the internet, there assets = liabilities + equity has been a steady increase in transport demands. Our range of services are tailored to your business, whether you’re on the road or in the office.

- No one enjoys paying taxes, but owing taxes is one the indicators that shows your business is achieving success.

- Good tax preparers will ask for all your W-2, 1099 and 1098 forms as well as other records and receipts to verify income, expenses and credits.

- Our expert team ensures that drivers from any region and state get high-quality and best-paying loads.

- Many truck drivers use spreadsheets to manage their finances on the go, but these can be time-consuming and prone to mistakes.

- Truckers can write off things like fuel, lodging, meals and vehicle maintenance.

Access documents at any time

Your logbook truck driver accounting services and/or electronic log devices (ELDs) are your best proof of entitlement to per diem expenses and record of your drive time, breaks, and miles driven. Pay the balance in full every month to avoid racking up additional business debt. We help truckers properly claim per diem for meals and lodging for overnight trips. Sign up for our newsletter and be the first to know about the latest tax news. You can hit the chat button this page or send us an email to to set an appointment to talk with one of our experts. With a secure portal, you can log in to your personal account at any time and know that your information is safely password-protected.

Bookkeeping Services for Trucking Companies

The downside is that effective accounting is challenging to execute, and you may find it difficult to devote the required resources to the project. Keeping track of all the changes in the tax code can be a nuisance and knowing how and when to apply for write-offs is more difficult than it may seem. With truckers filing taxes every quarter, trucking CPAs can help simplify the process and take advantage of any trucker-specific tax deductions. SSB recognizes that federal and multistate tax issues are a major concern of the trucking industry and stays on top of the ever-changing tax laws. We understand that each state considers different factors in determining whether a trucking company has nexus in the state.

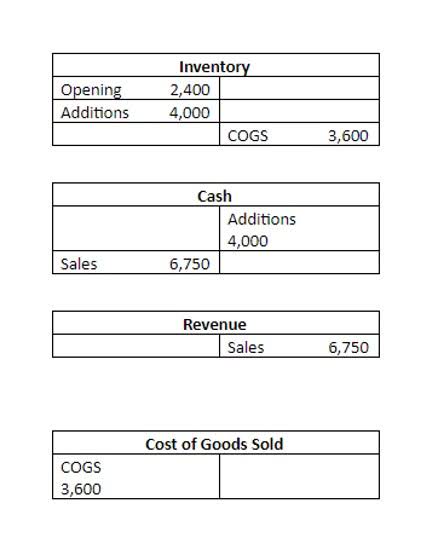

We stay current on the ever-changing tax code that impacts the industry. Most truckers use trucking bookkeeping services to handle their bookkeeping needs. No matter your fleet size or business needs, there is a trucking bookkeeping service to help you manage your transportation company. Cash-based or accrual-based accounting is one of the most critical decisions a trucker or owner-operator will make. Cash-based accounting is easier, recording a transaction when money changes hands.